Today marks day one for David Locke, the Chief Ombudsman of the Australian Financial Complaints Authority (AFCA).

Mr Locke says AFCA was established to help consumers and small businesses resolve a complaint about a financial product or service for free.

"It could be about credit or investments, financial advice that's been received, or it could be disputes that might be about super or insurance products and insurance claims so really right across the financial spectrum.”

He adds, that AFCA’s determinations are binding.

“We are going to be very busy, we're expecting in excess of 55,000 disputes alone in the first year so we know there is a big demand out there. Ultimately though what we want to do is work with the financial services firms to stop the disputes happening in the first place."

David Locke Source: SBS

Consumers are encouraged to discuss their issues with their financial services provider first - before contacting AFCA online at or by calling 1800 931 678.

Mr Locke says the authority was created following recommendations of the 2016 Ramsay Review into external dispute resolution.

“The initiative this has come out of was a review which actually started in 2016 which the government commissioned to look at how we can improve the dispute resolution processes for people who have these sorts of problems but of course, the royal commission has demonstrated how graphically why there is a need for this new body.”

Australia's banks are counting the cost of the royal commission – as the bank reporting season continues.

NAB's the latest to reveal its performance to the Australian Stock Exchange, delivering a 14 per cent decline in full-year cash profit to $5.7 billion.

CEO Andrew Thorburn says it includes $360 million worth of charges for customer remediation.

“It's really been a tough year, and a challenging environment with questions of reputations and trust a housing slowdown, margin compression and many global developments of note.”

Mr Thorburn adds, restructuring costs also hit its bottom line, as it simplifies its business.

“Consumer bank and wealth has been tough mainly due to home loans, with the impact of slower housing credit growth sustained competition, a changing mix and margin pressure”

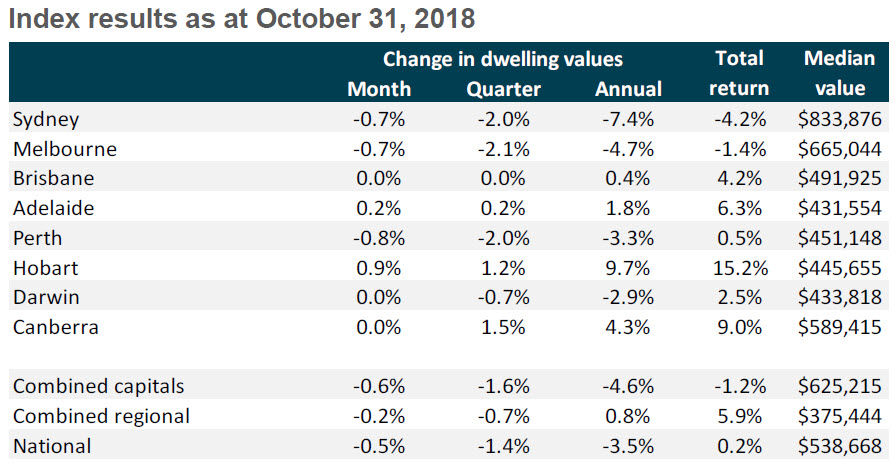

The housing slowdown is continuing - CoreLogic says national prices declined 3.5 per cent in the year to October with a median value of $538,000.

October house prices. Source: CoreLogic

CoreLogic’s Cameron Kusher says further declines are expected.

“We think that, if we look at Sydney and Melbourne, the downturn is ingrained at the moment, we'll see values fall for this year and probably well into 2019 as well, and that's going to drag down the national average as well.”

Investment bank - UBS - warns national house prices will likely drop 10 per cent by 2020.

Mr Kusher adds, it could impact consumer sentiment.

“People have really felt the impact of rising property prices, making them feel wealthier and prepared to spend, now that's in reverse, that's definitely going to have an impact on consumer spending.”